Gold's US$3,000 Price Tag Hides a Massive Undervaluation

Indigo’s Research Proves Gold Remains Cheaper Today Than In 1971 When Priced at 38 US$

By David J Mitchell

It's demonstrably true that gold's value today significantly undervalues its worth compared to 1971, when it was priced at a mere US$38.

The last decade has witnessed significant shifts, spearheaded by an unprecedented net global gold-buying surge by global Central Banks over the past 15 years. This prompts critical questions that demand answers:

- What are the underlying motivations fuelling this relentless gold accumulation?

- What is gold's current role and strategic positioning within the monetary base?

- How will the new central bank regulatory requirements outlined in Basel III impact gold's price trajectory?"

A critical misconception persists among investors regarding the profound undervaluation of gold once you factor in correctly the enormous increase in money supply (a debasement of the US$ currency), even when priced at US$3,000.

This is compounded by a failure to recognize gold's increasingly vital role in the monetary system itself, where it is rapidly being reinstated as both a form of money and a foundational asset base.

Let me be specific, the Bank for International Settlements (BIS) has introduced a new global banking framework, Basel III, which carries significant implications for banks and financial institutions worldwide. A key aspect of this framework is the reclassification of physical gold as a Tier 1 asset, effective July 1, 2025.

Tier 1 Asset Designation:

This reclassification signifies that physical gold is now recognized as one of the highest-quality assets that banks can hold to meet their regulatory capital requirements. Tier 1 capital now consists solely of sovereign fiat currencies, sovereign government bonds, and gold, representing the core capital of the banking system and the highest form of regulatory capital.

Implications for the Gold Market:

- Increased Demand: The reclassification is expected to drive increased demand for physical gold as banks and institutions adjust their portfolios to comply with the new Basel III requirements.

- Price Fluctuations: This increased demand is going to exert upward pressure on gold prices.

- Shift in Market Dynamics: The reforms are anticipated to shift the gold market towards more physical gold-centric pricing, reducing the influence of paper gold and derivatives.

The implementation of Basel III is being phased in over several years, with the full impact anticipated by 2028.

To be unequivocally clear, gold is undergoing a fundamental redefinition, positioning it as both a primary form of money and the cornerstone of our future financial system. We are seeing this directly with Central Banks Sovereign Reserve portfolio management instigating over this last 15 years the largest physical gold buying spree in modern history.

In light of the unprecedented global debt crisis, a significant revaluation of gold is essential to fully support and stabilize this system.

While there's no universally accepted 'ideal' percentage for gold backing of a monetary base due to varying historical practices and economic theories, the gold standard era saw an average cover ratio of gold reserves to the currency in circulation (the monetary base) of approximately 50%.

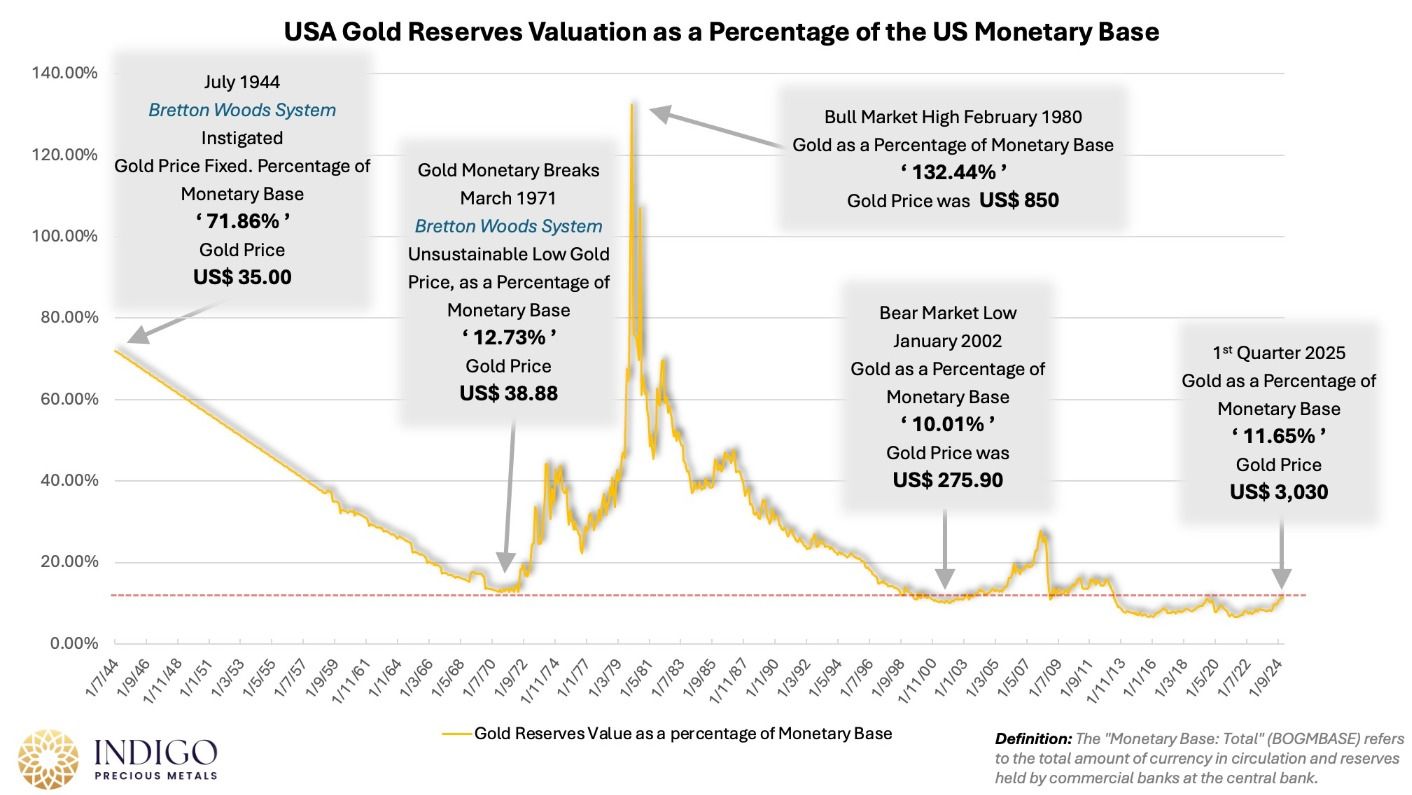

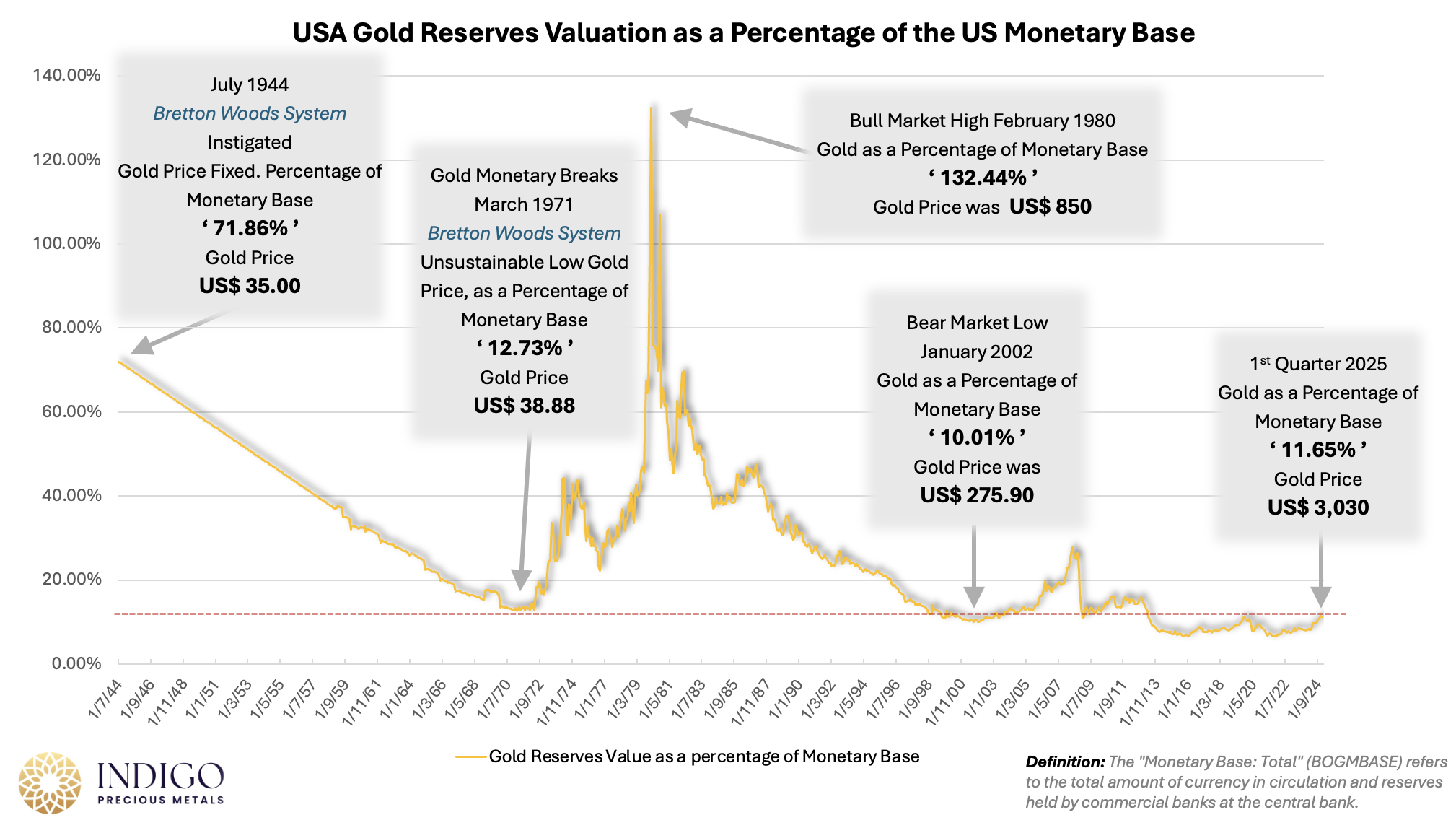

But it has to be said, in 1944, the Bretton Woods System was established when the United States held substantial gold reserves, totalling 574 million ounces (19,690 tonnes). Valued at US$35 per ounce, these reserves represented a cover ratio of 72% of the USA's monetary base, which was approximately US$28 billion. By 1971, however, this percentage had plummeted to 12.73%. This sharp decline was due to the U.S. government's rapid expansion of its monetary base, driven by excessive spending, coupled with a reduction in gold reserves to approximately 9,070 tonnes.

So, let’s look at the historical Monetary base of the USA since 1944 to today versus market values of the US Gold reserves, to fully calculate how undervalued gold is today….

Looking ahead, gold is being strategically positioned as a vital monetary tool, aiming to achieve a weighting of at least 40% relative to the monetary base. This shift is expected to play a crucial role in mitigating the ongoing debt crisis within the global monetary system.

This can be achieved through two primary mechanisms: either a substantial accumulation of additional gold reserves, which would inherently drive prices significantly higher, and a revaluation of gold by the end of this decade to reflect its intrinsic historical valuation and acknowledge its fundamental historical role as a cornerstone asset underpinning our financial system.

Also, not forgetting that the anticipated continued expansion of the US$ Monetary Base, this implies considerably higher gold valuations relative to the US dollar.

Therefore, I firmly believe that gold reaching US$12,000 to US$15,000 is an inevitable outcome and could prove to be very conservative.

Definition:The "Monetary Base: Total" (BOGMBASE) refers to the total amount of currency in circulation and reserves held by commercial banks at the central bank,

- Definition:

The monetary base is a key measure of the money supply, representing the total amount of money created by the central bank.

- Components:

It includes:

- Currency in circulation: Physical banknotes and coins held by the public.

- Bank reserves: Deposits held by commercial banks at the central bank.

While the monetary base is a component of the money supply, it's a much narrower measure than broader aggregates like M1 or M2.

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery across the world.

Consider the safest option of segregated, allocated vault storage at Le Freeport Singapore with IPM Group.

Disclaimer : The information contained in this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.